It provides a grounding in the legal foundations of insurance contracts and the actors and features of the insurance markets as well as the main classes of insurance and products.

Students are then introduced to the main insurance operations, including underwriting, claims, customer service and policy administration.

The course takes the participants through some regulatory aspects including the capital adequacy, conduct of business and ethics.

This training course is designed for learners to understand the need for excellent customer service in insurance and how to achieve it.

Trainees are first introduced to basic insurance concepts that the customer service function should support, such as the duty of disclosure and good faith and the roles and duties of the various players in the insurance market.

We will then explain the segmentation of insurance customers, their respective demands and needs and how those demands and needs and are met and the importance of obtaining customer feedback to measure performance.

The course will then focus on important skills for all insurance employees such as handling

confidential information, communication, dealing with conflict, managing workload,

teamwork, ethical conduct and complaints handling.

Closing sales is an essential part of customer handling in the modern insurance enterprise,

therefore in the final part of this course participants are taken through the sales process.

This Certificate in Health Insurance Principles and Practice awarded by RISC Institute is single unit qualification developed specifically for all those working across the health insurance sector in the UAE.

It provides foundation and technical knowledge in health insurance principles and practice that every person working in the sector must have to be able to provide advice to customers and to perform functional and support roles in distribution, sales, underwriting, claims and administration of health insurance products.

The course details how universal health care for all citizens and residents is provided in the UAE, and the regulatory bodies (at both Federal and Emirate level) that have responsibility for the regulation of insurance and health insurance.

Bottom Line Benefits

- Understand the concept of Universal Health Care and different types of health insurance plans that support it.

- Know how Universal health care for all citizens and residents is provided in the UAE, and the regulatory bodies (at both Federal and Emirate level) that have responsibility for the regulation of insurance and health insurance.

- Build a foundation in health insurance operations and develop skills to deliver exceptional client service

- Gain the confidence to explain to customers the coverage and benefits of health insurance policies and advise them on common terms, conditions and exclusions when choosing their policies.

- Set yourself apart with the technical knowledge needed for risk assessment, underwriting, pricing and claims handling of health insurance.

- Boost your career opportunities with a certification by a recognized and reputable training institution

Who should take this course

- All personnel working in operations, sales, customer service and and underwriting, claims and technical support departments of insurance companies and insurance brokers licenced to provide health insurance in the UAE.

- All personnel working with third party administrators handling health insurance claims

- Individuals who advise upon, markets or sells health insurance products by any marketing channel whatsoever

- Individuals who are or aspire to be registered as Permitted Health Insurance Representative (PHIR) with the Dubai health Authority

- All personnel working with hospitals, clinics and other healthcare providers who handle insurance claims, medical biling and coding .

- Thise working with employers and sponsors in the purchase and handling of group medical insurance policies

This course assumes no prior knowledge of insurance.

What you will learn

By the end of this course successful participants will be able to:

- Understand the pinciple of Universal Health care as directed by the World Health Organization.

- Know the regulatory bodies (at both Federal and Emirate level) that have responsibility for the regulation of insurance and health insurance.

- Describe the main provisions of the laws issued by HAAD and that apply to the Emirate of Abu Dhabi in respect to health insurance.

- Describe the main provisions of the laws issued by and that apply to the Emirate of Dubai in respect to health insurance.

- Apply the legal principles of insurance to health insurance contracts: Insurable Interest; Good Faith; Indemnity; Proximate Cause.

- Explain the General Terms and Conditions, Definitions, Coverage, benefits and exclusions under the Abu Dhabi Health Insurance products.

- Explain the General Terms and Conditions, Definitions, Coverage, benefits and exclusions under the Dubai Health Insurance products.

- Describe Healthcare coverage under other types of insurance policies.

- Know the process of risk assessment, pricing and underwriting health insurance.

- Describe the health insurance claims process and settlement.

- Describe the impact of fraud and abuse on the health insurance markets.

- Know how insurers control claims costs and identify waste, fraud and abuse.

- Apply best practice for the conduct of business, professionalism and ethics in insurance.

- Know the principles of data protection and their application to customer records.

How you will learn

This course is being offered by RISC institute in self-paced learning format through our e-learning portal.

With self-paced learning, you set your own schedule to follow the animated video tutorials covering the all the syllabus sequentially by learning objective and by topic. There are 10 hours of video in total.

At the of each learning objective, you complete practice quizzes and further learning activities and resources. A forum is provided so that you may post questions to the tutor.

Once you have completed the elearning activities and reviewed the reading resources (Course text-book and powerpoint presentations) you can take the mock examination to test your preparedness for the examination.

Your quiz scores and mock exam scores are kept in your gradebook.

You will be supported by our customer service team throughout your learning journey.

The following are the learning resources and activities included in this course.

Learning Activities

![]() Animated videos for each learning objective

Animated videos for each learning objective

![]() End of topic quizzes

End of topic quizzes

![]() Tutor moderated forum for posting questions

Tutor moderated forum for posting questions

Learning Resources

![]() Digital course textbook

Digital course textbook

![]() Online viewing of powerpoint presentations

Online viewing of powerpoint presentations

Support

![]() One examination entry to be taken by appointment

One examination entry to be taken by appointment

![]() Grade Book

Grade Book

![]() Customer help line

Customer help line

How you will be assessed

You will be assessed through a Multiple Choice examination delivered online. You will have 2 hours minutes to complete 75 questions. the passmark is 70 percent.

When you are ready to take the exam, simply contact our customer service team for an appointment and you will be guided through the process.

What you will earn

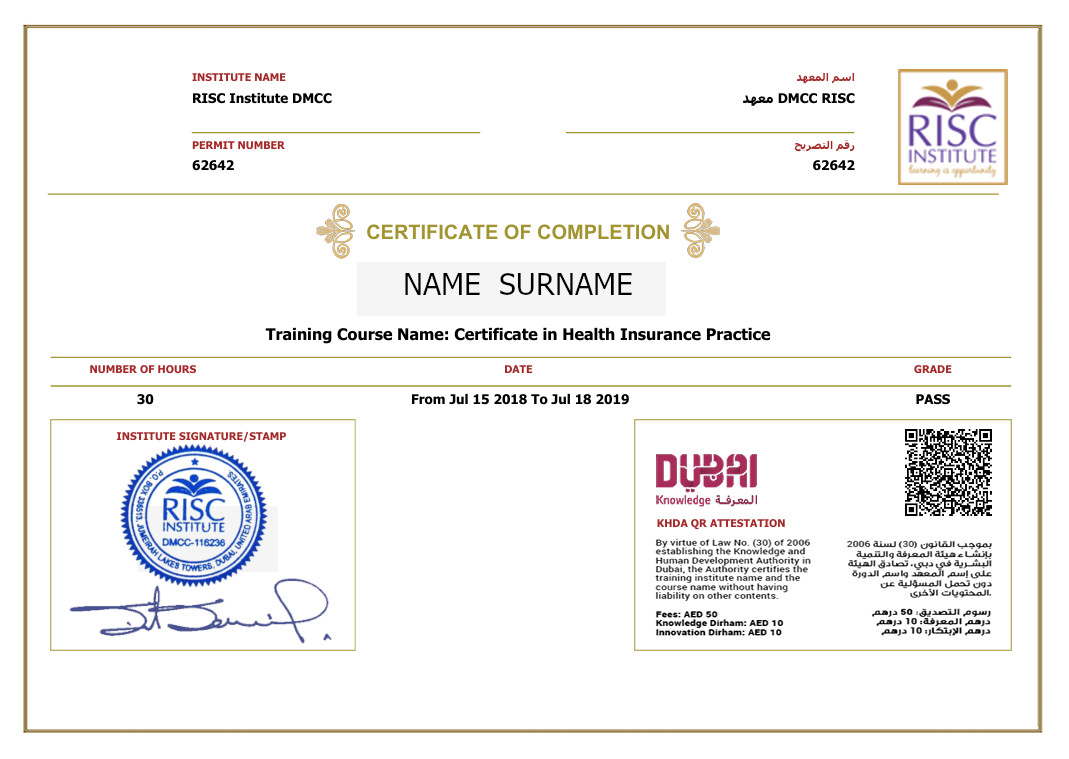

Certificate of completion by examination

Certificate of completion by examination

A certificate of completion will be awarded by RISC Institute once you pass the examination.

A digital version of the certificate will be downloadable from the e-learning portal immediately. A printed hard copy will be sent to you to your registered postal address within 7 days.

KHDA attestation

KHDA attestation

This qualification awarded by RISC Institute is approved and certified by the Knowledge and Human Development Authority of Dubai.

Your certificate will be attested by KHDA and verifiable through the KHDA system.

RISC Digital Badge

RISC’s digital badges are a verifiable way to share your accomplishments with others. Digital badges can be shared via social media, email signatures, or digital business cards.

How much time do you need to dedicate

The course comprises ten hours (10) hours of animated video lessons, practice quizzes and online reading resources.

We expect that you should be able to complete the course in approximately 30 hours of study time.

Your enrollment provides you with 60 days access to our e-learning resources. You can can take your exam at any time within this 60 days from your enrollment.

The price for enrollment into this course is AED1,575 including VAT. This includes:

- 60 days access to the E-learning course

- PDF textbook

- One examination entry valid for 60 days from enrolment

- Printed Certificate of Completion

- KHDA Certificate

Price for re-sit: AED250

Giving customers personal financial planning advice and helping them to develop a financial plan is a highly skilled and technical profession. Insurance companies must ensure that their advisers are well equipped with such knowledge and skills to provide sound financial planning advise and the right products to match.

During this course we explain the process of financial planning from assessing client needs, fact finding, making recommendations, dealing with objections and closing the sale. We explain in detail the range of life insurance protection products and their features and how such features affect suitability for specific clients.

We also explain the range of savings

and investments products offered by life insurance companies and financial institutions and

the factors that affect the choice of product.

Throughout the course we provide guidance on best practice and the conduct of insurance

business rules as well as the duties of the financial adviser.