- Know how to fulfil customer requirements in the insurance sector.

- Understand the importance of customer feedback to improve service in the insurance sector.

- Understand the importance of good communication to maintain and build client relationships in the insurance profession.

- Know how to deal with conflict within an insurance environment.

- Understand the importance of keeping accurate and confidential records when dealing with customers.

- Know how to manage own workload and time to meet business requirements and timescales.

- Know how to work with others to achieve team and organisational objectives.

- Understand the sales process.

- UKnow how to increase sales activities.

Download the full syllabus from the CII website

Mr. Silvan Said ACII, ARM, Chartered Insurance Practitioner

Founder, Managing Director

Mr. Said is a senior risk and insurance executive with over 36 years experience in the industry and is an Advanced Technical Insurance trainer accredited by the CII. He has been actively involved in talent development for the insurance industry since 2002, consulting and delivering courses in Malta, Eastern Europe and the MENA region.

Over his twelve years experience in the GCC, Silvan has developed a deep understanding of the training and development needs of the insurance market in the GCC. In March 2015, he established RISC institute and it quickly became the undisputed leading training institution for the insurance industry in the UAE both in terms of attendance numbers and qualified students.

Check out his profile here.

Ms. Pauline Azzopardi BSc., ACII., Cert FS, CeFA.

Certified Trainer

Ms. Azzopardi’s career spans twenty two years activity in the Financial Services Industry. She has occupied several positions in the industry starting in 1998 as an associate with Allied Dunbar UK, specialising in commercial lending, investment advice on U.K. and offshore bonds, unit trusts and mixed portfolios, mortgage arrangements with U.K. and international banks and building societies, pension advice and personal financial planning.

Ms. Azzopardi has been lecturing on financial services, Life Assurance and Pensions with the Malta International Training Centre since 1995 and at the Malta Institute of Management since 2002. She is the current lecturer in the Diploma for Financial Advisers (“DipFA”) at the Institute for Financial Services in Malta, affiliated to the IFS School,of Finance, UK.

Check out her profile here.

Interact with the tutor

![]() 30 hours of Guided Learning Hours through Virtual Live Classes

30 hours of Guided Learning Hours through Virtual Live Classes

![]() Weekly Schedule

Weekly Schedule

![]() Over 150 end of topic practice quizzes

Over 150 end of topic practice quizzes

![]() Case studies and assignments

Case studies and assignments

![]() Grade Book

Grade Book

![]() Boot Camp (Live virtual session)

Boot Camp (Live virtual session)

Private Study

![]() Interactive online lessons

Interactive online lessons

![]() Short videos explaining key concepts

Short videos explaining key concepts

![]() Online viewing of powerpoint presentations

Online viewing of powerpoint presentations

![]() Practice exam with feedback

Practice exam with feedback

![]() Links to further learning resources

Links to further learning resources

![]() Live class recordings

Live class recordings

![]() Mobile app

Mobile app

Group Dynamics

![]() Discussion forum

Discussion forum

![]() Messaging

Messaging

![]() Group work

Group work

![]() Profile sharing

Profile sharing

![]() Customer help line

Customer help line

![]() Whatsapp group

Whatsapp group

CII registration

![]() CII Digital learning materials (ebook)

CII Digital learning materials (ebook)

![]() CII Revision mate

CII Revision mate

![]() In-house CII exam schedule

In-house CII exam schedule

![]() Remote Inviglation (optional)

Remote Inviglation (optional)

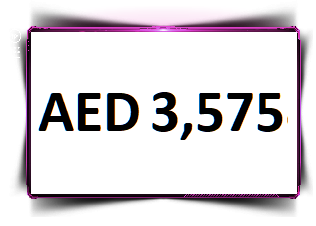

This price is inclusive of 5% VAT.

A non-refundable admission fee of AED 1,000 is payable upon registration to confirm your enrollment. This fee will be deducted from the total programme fee. For further information, see our Cancellation and Refunds Policy.

Enrollments are subject to our Terms and Conditions

The Award in General Insurance is the first and compulsory unit out of three that make up the Certificate in Insurance or Certificate in Insurance and Financial Services of the CII. You can download the CII's qualification brochure for further details.

RISC Institute offers packages at extremely advantageous terms if you wish to pursue the Cert. CII qualification. Check details of our offer here

In order to assist individuals, RISC offers installment plans for Cert CII Packages of up to four (4) payments by bank transfers or monthly direct debit from credit/debit card.